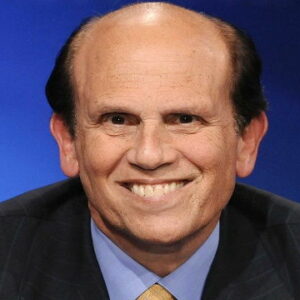

American philanthropist and former financier Michael Milken is best known for increasing the yield on high-yield bonds. Michael, who was Jewish by birth and upbringing, began his work as an intern at the former investment bank “Drexel Harriman Ripley.” His complex system of high-yield bonds began to pay off handsomely in the middle of the 1980s. Nevertheless, despite his success, the authorities continued to investigate him, and the number of experts were determined to expose him as fraud. He was found guilty of racketeering and security fraud in an insider trading investigation that took place in 1989. He admitted to some of the charges, and he now faces a 10-year prison term and a USD 600 million fine. Michael made a significant adjustment in his behavior after being released from prison and started taking part in charitable endeavors. He holds the 488th position on Forbes magazine’s list of the “World’s Richest People” with a reported net worth of over USD 2 billion. ‘Fortune’ magazine referred to him as “The Man Who Changed Medicine” in November 2004 as a result of his substantial gifts to life-threatening illness research.

Early Childhood & Life

Michael Milken was born into a Jewish family on July 4, 1944, in Encino, California. From “Birmingham High School,” he received his diploma for high school. He has always been a self-reliant individual and worked at a diner to make ends meet. He attended school alongside Sally Field and Cindy Williams, both of whom are accomplished actors.

He wasn’t a business person and earned a “Bachelor of Science” from the “University of California, Berkley.” He had a tendency toward science. He excelled in school and won numerous awards, including membership in the fraternity “Sigma Alpha Mu.”

He decided to pursue an MBA at the “Wharton School” of the “University of Pennsylvania” after graduation, where he displayed his innate analytical prowess. He researched the views put forth by author W. Braddock Hickman, who claimed that a portfolio of investment-grade bonds would be far less profitable than one that consisted only of non-investment-grade bonds.

This information contributed to the development of an uncommon business sense, which eventually got him into conflict with the law. Michael’s Wharton teachers were so taken with him that they helped him secure a summer internship with Drexel Harriman Ripley, a traditional investment bank, in 1969.

After receiving his MBA, he started working as a low-grade bond research director at the investment firm “Drexel,” then known as “Drexel Firestone.” He gained unparalleled knowledge from this. He was also given some money and the chance to work as a merchant. Over the course of the following 17 years, only four of his months were unsuccessful thanks to his expertise.

Career of Michael Milken

Drexel and Burnham & Company amalgamated in 1973 to form Drexel Burnham. The name “Drexel” was only chosen because of its brand value and market repute, despite the fact that the company actually belonged to “Burnham.” Michael kept his position at “Drexel” and eventually rose to the position of head of convertibles at the new company.

His supervisor, Tubby Burnham, also graduated from “Wharton.” Therefore, it wasn’t difficult for him to persuade him to launch a department for high-yield bonds. He offered a 100% return on all the investments while outlining the advantages, which appeared reasonable to Tubby as well. Michael and his boss had enough money by the middle of the 1970s. Several years later, Michael expanded his business and established his high-yield bond business in Century City, Los Angeles.

In the ensuing years, Michael’s business expanded quickly and he was successful in raising a sizable sum of money, which caused his wealth to steadily increase. Some firms engaged in leveraged buyouts benefited tremendously. The majority of these businesses carried a “very confident letter.” While fully aware that what he was doing was not entirely lawful, Michael persisted.

Michael chose to keep a low profile and never let the attention he earned knock on his door, despite being a highly well-known figure in the investing industry. He was regarded as the most influential financier in America. Michael was having a blast, and “Drexel” also benefited significantly. It is said that Michael received a salary of more than $500 million in one particular year.

By that point, “Drexel Burnham” had grown to be one of the largest American financial institutions, and Michael was solely credited with its success for his ingenious handling of trash bonds. This further resulted in his receiving half of the company’s annual revenues, and his position quickly rose to the top of the US salary list.

Michael had aspirations of starting his own business and leaving “Drexel” in 1989. The “International Capital Access Group” was quickly founded by him. The same year, he was accused of numerous frauds, which led to the demise of his career and the collapse of his life.

Accusations and incarceration

His collapse had begun in 1986, when Ivan Boesky, a client of “Drexel,” was found guilty of insider trading, a serious offense. He accused Michael and “Drexel Burnham,” which sparked an extensive investigation. In 1988, “Drexel” and “Michael” were both accused of high-profile financial scams. As a result, “Drexel” was compelled to start negotiations with the government, which resulted in his having to pay a fine of USD 650 million.

When Milken quit “Drexel Burnham” to create his own business, “Drexel” quickly went under. The fragmented network of junk-bond issuers and buyers was to blame for this. The remaining customers abandoned the sinking ship as the business approached bankruptcy, which led to the company’s bankruptcy in 1990.

Michael was charged with several major offenses, and he entered a guilty plea for six of them. He was given a six-year prison term and had to pay a steep fine of USD 600 million. Additionally, he was permanently barred from engaging in the securities industry. Later, his sentence was cut to two years in prison, and he was freed after only 22 months.

Existence After Prison

Together with his brother Lowell Milken, Michael Milken established the “Milken Institute for Job and Capital Formation.” In 1993, he founded the “Association for the Cure of Cancer of the Prostate” as a result of his challenging prostate cancer battle. He established “FasterCures,” which supported research into the treatment and prevention of fatal diseases, in the same year he worked with other philanthropic organizations.

He has started a number of nonprofit organizations to raise money for cancer research in particular. He claimed that his mother’s breast cancer and his own experience with cancer served as the primary sources of inspiration for these undertakings.

He established “Knowledge Universe,” “Knowledge Learning Corporation,” and “K12 Inc.” in 1996, all of which aimed to benefit students and educational institutions.

Individual Life of Michael Milken

Lori Anne Hackel, his high school sweetheart, is wed to Michael Milken. Three kids were born to the couple.

Michael Milken Net Worth

American financier and philanthropist Michael Milken has a $4 billion net worth. Financial entrepreneur, philanthropist, and convicted felon Michael Milken is well-known for creating high-yield bonds, sometimes referred to as trash bonds. He was charged with racketeering and securities fraud on 98 counts in 1989. He was finally given a ten-year sentence that was later reduced to two. The Securities and Exchange Commission also imposed a $600 million fine on him and permanently prohibited him from the securities sector.